Maximize the biggest share of your refund

In July, we took a look at the Retro program in Washington state, which gives employers the opportunity to earn refunds on their workers’ comp premiums, often through an industry association that provides access to the Retro group, safety resources, and claims management expertise.

These refunds are only possible if each employer in the group has a robust safety program along with a light-duty program to get injured employees back on the job. In other words, performance makes the refunds possible. So, let’s explore Retro performance and the ways you can improve your company’s individual performance.

Participating in Retro through an industry group spreads the risk, giving each employer the chance to share in a refund, even if some companies have a bad year. Many Retro groups will divide the refund among participants based on two factors:

- Premium – The amount that your employer contributed to the group through premium paid to L&I

- Performance – How well your employer was able to minimize claim costs during the year

What’s a loss ratio in workers’ comp?

In order to maximize the performance portion of the refund, your loss ratio needs to be as low as possible. What’s a loss ratio? It’s easiest to explain with an example:

If a company pays $100,000 in workers’ comp premiums, then has claims costs of $50,000 during the year, the loss ratio for this company is 50%.

In other words, Loss Ratio = Claims Costs / Premium Paid

Your loss ratio is used to calculate your performance share of the refund. Companies with no losses or low losses will get a higher percentage of the performance share. Companies with a loss ratio above 1.0 will not get any performance refund, as their losses that year were higher than the premium that they paid into the group.

Retro refunds – How performance share is calculated

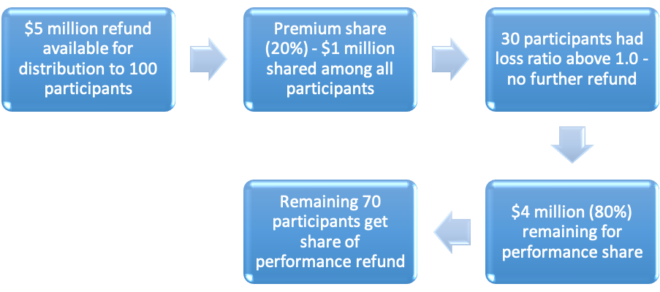

Imagine a Retro group with 100 participants, 70 of which have a loss-ratio less than 1.0. The group has $5 million to distribute from the plan year. Their contract specifies that 20% of the refund is based on premium, with 80% based on performance.

100 participants will share this small, premium portion of the refund

Only 70 participants share the large, performance portion of the refund

As you can see, while all participants share a small portion of the refund, the much larger benefit goes to those companies that qualify a piece of the much-larger performance portion.

Here’s a more-detailed look at the process:

How Retro Refunds are split into Premium and Performance Shares

How to maximize performance

As always in Retro, the best performers have good programs in place to manage:

- Safety, in order to prevent injuries and claims

- Return to Work, so that injured employees are back on the job as soon as possible

If it’s been a year since your last Approach Safety Visit, contact us to schedule a new visit or virtual review.

Book your Approach Safety Visit

If an injury or accident does occur, contact your Approach retro coordinator as soon as possible. You can even use our Online Injury Reporting form to get the ball rolling. Don’t wait for paperwork from your employee or L&I — it takes 55 days, on average, for L&I to learn about a claim! It’s far better if we can begin helping you within a day of the incident.

Companies with a loss ratio above 1.0 will not get any performance refund, as their losses that year were higher than the premium that they paid into the group.

Your Approach retro coordinator will assist you throughout the claims process, starting by ensuring that the employee is able to return to work, either in their usual job or a light-duty position. If they can’t return to any work, we may ask you to pay Kept-on-Salary (see last week’s Ask Approach for more on Kept on Salary).

Again, all of these efforts are focused on keeping costs low, which will keep your refund as high as possible.

Bigger refunds, lower rates

The best thing about keeping your loss ratio low is that it also helps keep your rates as low as possible. Retro refunds are a great thing, but it’s even better to pay less to L&I in the first place. Lower rates make that happen!

Speaking of rates, there’s still time to register for Brain Trust, this Tuesday, Nov 17. We’ll be reviewing the 2021 L&I EMR process — including a look at your company’s proposed rates for next year.

Register now to for the EMR Rates Brain Trust (Open to Approach clients only)