Save money with better safety and claims management

The basics of the retro refund program for Washington state employers are simple – companies who implement best practices for safety and claims can potentially earn refunds on their workers’ comp premiums.

The actual refunds and distributions can be trickier to understand. Here’s an overview to show how it works and how your company can benefit from retro and more.

When your company joins Retro

You will most likely participate in Retro through a trade association for your industry, which sponsors the group. L&I also offers Retro for individual companies, but these are usually riskier and can be less financially advantageous than participating in a group.

Retro groups accept new members on a quarterly basis (so long as you are not a current member of a different group). When you join a retro group, you become a participant until the end of that plan year, at which point it’s possible to leave or switch groups.

Once active in Retro, our intention is that you will have less administrative tasks to complete because you’ll be supported by a retro coordinator on behalf of the Retro group. “Many employers discover that the claims and safety support provided by their retro group is a bigger benefit than the refunds!” says Liz Evans, business development manager at Approach.

Retro refund schedule

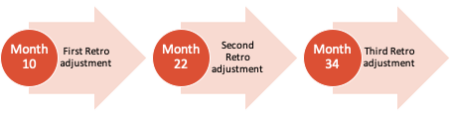

While most claims are closed within the plan year, others take longer to manage and close. Therefore, the retro calculation for a given plan year is calculated three times. The “first adjustment” takes place 10-months after the close of a plan year, the “second adjustment” takes place at 22-months and the “third adjustment” and final one takes place at 34-months post the end of the plan year.

Learn more about Freeze Dates, an important part of calculating each adjustment

Claim costs impact your company for four years or more, so you need to have best practices in place to succeed in Retro.

Retro adjustments at a glance (months after plan year ends)

As you might guess, claims costs often increase between each adjustment. As a result, most associations withhold all or part of a refund until the third and final adjustment takes place. This way, you won’t have to worry about receiving a bill if extra premium is assessed.

How are Retro refunds calculated?

Here’s a simplified look at how the adjustment process works:

- The workers’ comp premiums paid by all companies in the Retro group are totalled up. This is standard premium that was actually paid by your group during the plan year.

- The claims costs for all companies in the Retro group are totalled up. Various administration charges are added. This is retro premium, which is based on the performance of your group as of the Freeze date.

- L&I subtracts the retro premium from the standard premium. If the result is greater than zero, the group gets a refund. Less than zero, an assessment is issued to make up the difference.

That’s where Retro gets its name — the retro premium is re-calculated retroactively, at each adjustment after the plan year ends. This allows L&I to issue a refund if the group has done better than L&I predicted when it set the standard rates.

Simplified Retro Calculation

Planning for long-term success

As we saw in the adjustment schedules, claim costs can impact your retro refunds nearly four years after the plan year begins. That’s why your company needs to have best practices in place to succeed in Retro. As Evans says, retro is a partnership and “the partnership employers enter when joining a group is taken very seriously by all parties – the member, the association and the claims administrator.” Your success (or challenges) will be shared by all other members of the group.

Your company needs two key ingredients to succeed in Retro:

- A safety program that’s well-developed and enforced, with buy-in from top to bottom in your organization. That’s because Retro is designed to incentivize safety and because the cheapest claim is the one that never occurs.

- Fast attention to workers’ comp claims, to make sure your injured employee returns to work as soon as possible and that their recovery keeps moving forward. At Approach, each client has a dedicated retro coordinator to assist with this and ensure the best possible outcome for each and every claim.

Liz Evans says, “Your group retro coordinator is constantly looking for red flags, checking your claim for proper adjudication, and performing financial analyses to help you make the right decisions on your claims, so both your company and retro group earn the maximum possible refund.”

Thousands of companies in Washington have found that Retro is the right choice for them, because it keeps their employees safe while providing unbeatable financial incentives.

Learn more about Retro and whether it’s right for your company at: https://www.pitb.com/services/retrospective-rating-programs/