If you saw this L&I Tweet on September 15…

News Release: L&I proposes keeping workers’ comp rates steady for 2021https://t.co/Bhy7ywEKHy pic.twitter.com/NfDPdjkGqz

— Labor & Industries (@lniwa) September 15, 2020

…you might have thought, “Well, that’s easy! L&I rates will be the same next year. Right?”

Wrong!!

Even though L&I is planning to keep its average rates the same for 2021, your company probably isn’t just average. And that means your rates most likely will go up or down next year.

Let’s take a look at why this is and how you can find out what’s in store for your company’s 2021 workers’ comp rates.

Why are my L&I rates changing?

Basically, the biggest reason your company’s workers’ comp rates go up and down is the EMR, which stands for Experience Modification Rate.

Register for our upcoming EMR Brain Trusts on October 15 or November 17.

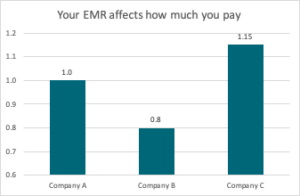

Just like car insurance, claims generally increase your rates, so the safest companies pay less for workers’ comp. coverage. Your EMR is a number that gets multiplied by the average rate – creating a specific rate just for your company.

L&I rates examples (In a nutshell)

Company A – EMR of 1.0

This company pays the average rates for its industry or work classes. The average rate is multiplied by 1.0, so it stays the same.

Company B – EMR of 0.8

This company does not have recent claims, so it gets a discount versus the average rate. The average rate is multiplied by .80 for this company, giving them a rate that’s 20% lower than average.

Company C – EMR of 1.15

This company had some claims, which have driven up its insurance costs. Their rates will be multiplied by 1.15 times the average, so they’ll pay 15% more than average (and 44% more than Company B).

How can I find my 2021 L&I rates for Washington workers’ comp

L&I published its proposed 2021 rates for each employer in September.

Approach clients – Look for an email from your Retro Coordinator this week with your company’s PERC attached.

You should review your Proposed Employer Rate Calculation (PERC) closely to make sure you agree — once the rates are finalized in December, that’s what you’ll pay for each hour worked by each employee in 2021.

Reading your PERC

The PERC is crammed with lots of numbers – it might look a bit scary. But there are two main areas you want to check:

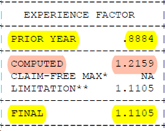

The first is right in the middle, labelled “Experience Factor:”

Experience Factor Section from a PERC

In this example, the company had a prior year rate of .8884 (or about 11% less than average). For next year, their claims costs would have caused an increase to 1.2159, or about 37% in a single year! Luckily, L&I doesn’t allow any company’s rates to go up more than 25% in a single year, so they’ve been given a rate of 1.1105.

Let’s imagine this is a furniture store and see what’s happened to their rates:

2020 rates –

$.8006 x .8884 = 71 cents per hour, per employer

2021 rates –

$.8006 x 1.1105 = 89 cents per hour, per employer

That’s a $369 increase for each full-time employee in 2021, just for workers’ comp! How will that affect their ability to compete next year? Would your company be able to absorb a 25 percent increase to your insurance costs?

How do claims impact workers’ comp rates?

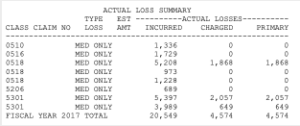

In the top right corner of your PERC, you’ll find the Actual Loss Summary. This section spells out the costs of each claim in a given year, which then feeds into the Experience Factor that we looked at above.

In Washington state, your 2021 workers’ comp rates are impacted by any claim which took place between July 1, 2016 and June 30, 2019. (You’ll see these listed as Fiscal Year 2017, Fiscal Year 2018, and Fiscal Year 2019.) The claims costs listed here feed directly into your 2021 rates.

That’s right! A claim that was filed in July 2016 can still cost your company money in December 2021. This is why we work so hard with our employers at Approach to prevent claims and, if a claim is filed, to keep claim costs as low as possible.

Actual Loss Summary from a PERC

One of the best ways to do this is keeping claims Medical Only. If you find any “Med Only” claims on your PERC, that means you earned a discount of about $3,000 per claim. If the amount in the Charged and Primary column is 0, the discount eliminated any cost to your company for that claim!

Protesting and understanding your workers’ comp rates

If you’re unsure about your PERC or think there’s an error, your Approach retro coordinator can help. For instance, we can look up claims history to double-check the numbers. You also have the right to protest your proposed rates to L&I – we can help with this if there’s an error in the calculation.

To find out more about rates and how to read your PERC, register for our upcoming EMR Brain Trusts on October 15 or November 17. You’ll get personalized help with your EMR and find out how to save money in upcoming years.

The Brain Trust is exclusively for Approach clients and there’s no cost to attend. Register now!